When Rachel Reeves, Chancellor of the Exchequer of HM Treasury hinted at a fresh levy on homes worth more than £500,000, the market went on edge. The suggestion surfaced ahead of the Autumn Budget 2025London, slated for Monday, November 26. Treasury officials say they are still in the modelling stage, but the idea could become one of the biggest overhauls of UK property taxation in a generation.

Background to the Fiscal Gap

The push for a new levy is not happening in a vacuum. The National Institute of Economic and Social Research released a September 2025 estimate that the government faces a roughly £50 billion shortfall in public finances. While Chancellor Reeves has publicly downplayed the figure, analysts argue a structural revenue boost is unavoidable.

At the Labour Party’s annual conference in Liverpool at the end of September, Reeves warned that "there is nothing progressive… about using one in every ten pounds of public money to pay debt interest." Her remarks were read by many as a tacit acknowledgement that new taxes are on the table.

Details of the Proposed Property Tax

The draft blueprint would introduce a proportional levy on owner‑occupied homes priced above £500,000. One version would apply the charge at the point of sale, meaning sellers of qualifying properties would pay the tax once the deal closes. Another variant could see the levy collected annually, more like a local property tax, potentially replacing parts of the existing council tax system.

Financial Times reporting on August 19, 2025 suggested the plan might also extend capital gains tax – effectively a "mansion tax" – to primary residences that cross the threshold, stripping the historic exemption for main homes.

- Threshold: £500,000 for owner‑occupied houses.

- Collection point: Either at sale or annually.

- Potential extra revenue: Up to £8 billion a year, according to Treasury modelling.

- Interaction with stamp duty: Could lead to a phased replacement of stamp duty land tax.

Critics say the move could dampen an already overheated housing market, while supporters argue it would distribute the tax burden more fairly and smooth out revenue fluctuations that currently depend on transaction volume.

Reactions from Markets and Analysts

Oliver Faizallah, Oliver Faizallah, head of fixed‑income research at Charles Stanley, told the Financial Times that gilt yields are likely to stay elevated until the Treasury spells out a concrete plan. "The autumn budget will inevitably bring higher taxes," he said, adding that investors are already pricing in a modest premium for UK debt.

Ollie Smith of Morningstar warned on October 7 that the Labour government’s pledge not to raise income tax, NICs or VAT could be sidestepped by targeting property wealth instead. "Reeves has so far shied away from bold action, but bold action is what is required," Smith argued, noting that a failure to act could jeopardise her political standing.

The Institute for Government bluntly stated that "it appears almost certain that Reeves will raise taxes this autumn after promising the 2024 budget rises were a one‑off." The think‑tank highlighted that existing stamp duty receipts swing wildly with market cycles, making a stable, proportional tax attractive from a fiscal‑planning perspective.

Political Implications and Party Stance

Labour’s 2024 election manifesto vowed not to raise the headline rates of income tax, national insurance or VAT. Yet the property tax proposal sidesteps those pledges, targeting wealth accrued in the housing market. Within the party, some MPs worry about voter backlash in coastal constituencies where house prices have surged.

Opposition parties are already gearing up. The Conservative shadow treasury team hinted they would label any new levy as a "home‑owner’s tax" aimed at middle‑class families, while the Liberal Democrats suggested a more progressive tiered system based on location and property type.

Reeves herself has walked a tightrope, emphasizing stability: "Our economic renewal will rest on keeping taxes, inflation and interest rates as low as possible," she said at the conference, echoing a broader Labour narrative of fiscal prudence mixed with targeted redistribution.

What Comes Next?

The Treasury is expected to finalise the modelling in early November, with a full set of numbers released alongside the budget speech on November 26. If the proposal passes the Commons, the legislation could be debated and enacted in early 2026.

Home‑owners with properties above the threshold should keep an eye on forthcoming guidance from HM Revenue & Customs, as the administrative details – whether the levy will be collected by the Land Registry, local authorities, or through a new online portal – remain under discussion.

In the meantime, property market watchers advise anyone considering a sale above £500,000 to factor in a possible extra cost, much as they would with capital‑gains tax or the higher rates of stamp duty that kicked in for second homes last year.

Frequently Asked Questions

How will the new levy affect first‑time buyers?

First‑time buyers whose purchase price stays below £500,000 will continue to benefit from existing reliefs. The proposed tax only targets owner‑occupied homes above the threshold, so a buyer snapping up a starter home should see no direct impact.

Will stamp duty be abolished entirely?

The Treasury’s modelling includes a scenario where stamp duty land tax is gradually replaced by a proportional property tax. No definitive decision has been announced yet, but officials say the two systems could run in parallel for a transition period.

What is the expected revenue from the proposed tax?

Early Treasury estimates put the extra take at between £7 billion and £9 billion annually, depending on whether the levy is charged at sale or collected yearly. The figure is intended to help narrow the £50 billion fiscal gap projected for the 2025‑26 financial year.

How might the levy influence house‑price growth?

Economists warned that adding a cost at the point of sale could temper price acceleration in the high‑end market, especially in London and the South East. However, the overall impact on national averages is expected to be modest, as the tax only affects a small slice of the housing stock.

When will the legislation be debated?

If Reeves includes the measure in the autumn budget, parliamentary debates could begin in late 2025, with a vote likely scheduled for early 2026. The exact timetable will depend on how quickly the Treasury finalises the tax framework.

RFU Backs Tom Curry Amid Contepomi 'Bully' Accusation After Twickenham Clash

RFU Backs Tom Curry Amid Contepomi 'Bully' Accusation After Twickenham Clash

Messi nets two in tearful Buenos Ayres farewell as Argentina beat Venezuela

Messi nets two in tearful Buenos Ayres farewell as Argentina beat Venezuela

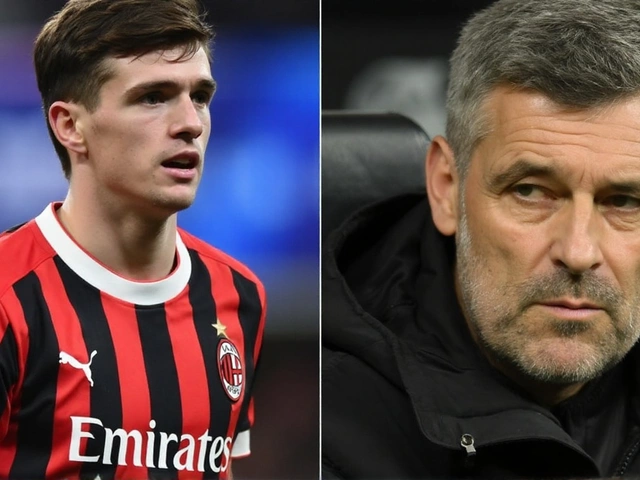

Serie A Week 2 Liveblog: Milan Breaks Dry Spell, Cremonese Pull Off Late Drama

Serie A Week 2 Liveblog: Milan Breaks Dry Spell, Cremonese Pull Off Late Drama

Firefighters Save Odeon Cinema in Beckenham From Nearby Blaze

Firefighters Save Odeon Cinema in Beckenham From Nearby Blaze

McTominay's Overhead Kick Sends Scotland to 2026 World Cup After 28-Year Drought

McTominay's Overhead Kick Sends Scotland to 2026 World Cup After 28-Year Drought